UBER INSURANCE

We've got you covered.

Uber has changed the competitive landscape of the rideshare and taxi industry. With the introduction of Uber, Intact insurance has developed a commercial insurance policy to cover Uber drivers. The purpose of the commercial policy is to provide insurance coverage to Uber drivers at no additional cost. The moment a driver makes themselves available to accept a ride request is when coverage commences. Below is a visual illustration of how Uber drivers and passengers are covered. For more information regarding Uber Insurance coverage please contact one of our experts at your convenience.

Personal Auto Policy Permitting Ridesharing

PHASE 0

Driver Using Vehicle For Personal Use

Primary Personal Auto Policy Permitting Ridesharing

-

Regular personal risk

-

Offline

-

No passenger

-

No ride

Intact/Uber Commercial Policy

PHASE 1

Driver Available To Accept Trip

Intact/Uber Phase 1 Commercial Policy Coverage

-

$1M Third Party Liabilty

-

Standard Accident Benefits

-

$1,000 deductible for Comprehensive and Collision*

PHASE 2

Driver En Route To Collect Passenger

Intact/Uber Phase 2 Commercial Policy Coverage

-

Accepted Ride

-

$2M Third Party Liabilty

-

Standard Accident Benefits

-

$1,000 deductible for Comprehensive and Collision*

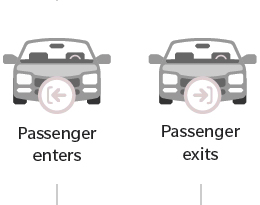

PHASE 3

Driver Transporting Passenger To Destination

Intact/Uber Phase 3 Commercial Policy Coverage

-

Picking up and transporting passenger

-

$2M Third Party Liabilty

-

Standard Accident Benefits

-

$1,000 deductible for Comprehensive and Collision*

*Comprehensive and Collision insurance coverage for physical damage is only available under the commercial policy to participating Uber drivers who have this coverage on their personal auto insurance policy.